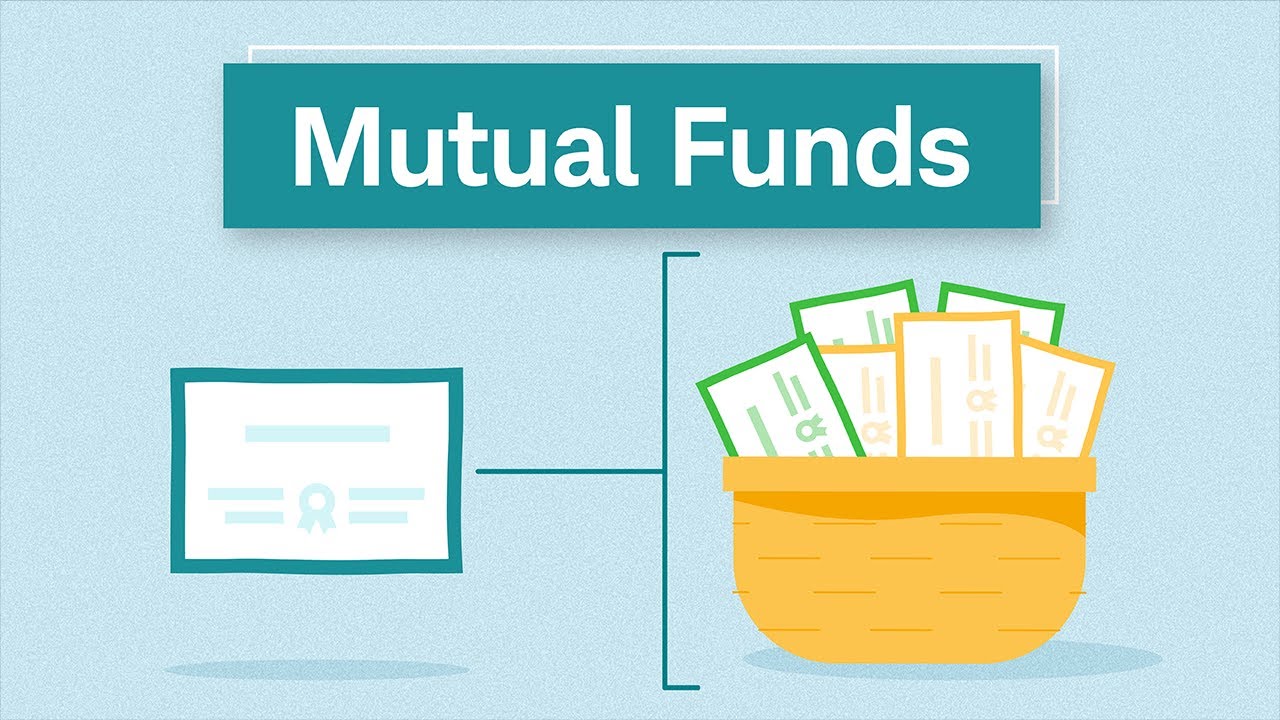

Mutual funds have become one of the most popular investment options for both novice and seasoned investors. They offer a way to pool money with other investors to purchase a diversified portfolio of stocks, bonds, or other securities. Whether you’re saving for retirement, a child’s education, or simply looking to grow your wealth, mutual funds can be an effective tool to achieve your financial goals.

What Are Mutual Funds?

A mutual fund is a type of investment vehicle that pools together money from multiple investors to buy a diversified portfolio of securities. These securities can include stocks, bonds, money market instruments, and other assets. The fund is managed by a professional fund manager, who makes decisions on which securities to buy and sell based on the fund’s investment objectives.

Types of Mutual Funds

- Equity Funds: These funds primarily invest in stocks. They are ideal for investors looking for long-term capital appreciation. Examples include large-cap, mid-cap, and small-cap funds.

- Bond Funds: Also known as fixed-income funds, these invest in bonds and other debt instruments. They are suitable for investors seeking regular income with lower risk compared to equity funds.

- Balanced Funds: These funds invest in a mix of equities and bonds, aiming to provide a balance of growth and income. They are suitable for investors who want moderate risk with steady returns.

- Money Market Funds: These funds invest in short-term debt instruments like Treasury bills. They are considered low-risk and are ideal for conservative investors looking for liquidity and capital preservation.

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500. They are passively managed and often have lower fees.

- Sector Funds: These funds focus on specific sectors of the economy, such as technology, healthcare, or energy. They offer higher risk and reward potential by targeting specific industries.

Benefits of Investing in Mutual Funds

- Diversification: By investing in a mutual fund, you gain exposure to a wide range of securities, which helps spread risk. Even if one asset underperforms, others in the portfolio may perform well, balancing out potential losses.

- Professional Management: Mutual funds are managed by experienced professionals who have access to extensive research and tools. This expertise can be beneficial, especially for those who lack the time or knowledge to manage investments on their own.

- Liquidity: Mutual funds are highly liquid, meaning you can buy and sell shares on any business day at the fund’s current net asset value (NAV). This makes it easy to access your money when needed.

- Affordability: You can start investing in mutual funds with relatively small amounts of money. This makes them accessible to a wide range of investors.

- Flexibility: With various types of mutual funds available, you can choose funds that align with your investment goals, risk tolerance, and time horizon.

Risks Associated with Mutual Funds

While mutual funds offer several benefits, they are not without risks. The value of your investment can fluctuate based on the performance of the underlying securities. Equity funds, in particular, can be volatile, especially in the short term. Additionally, mutual funds charge management fees and other expenses, which can impact overall returns.

How to Choose the Right Mutual Fund

Selecting the right mutual fund depends on your financial goals, risk tolerance, and investment horizon. Here are some steps to help you make an informed decision:

- Define Your Goals: Are you saving for retirement, a down payment on a house, or your child’s education? Your investment goals will determine the type of mutual fund that’s best for you.

- Assess Your Risk Tolerance: How much risk are you willing to take? If you’re comfortable with higher risk for potentially higher returns, equity funds might be suitable. If you prefer stability and income, consider bond or money market funds.

- Check the Fund’s Performance: Look at the fund’s historical performance, but remember that past performance does not guarantee future results. Compare it with similar funds and the relevant benchmark.

- Consider the Costs: Be aware of the fees associated with the mutual fund, including management fees, expense ratios, and any sales charges. Lower-cost funds can lead to higher net returns over time.

- Review the Fund Manager’s Track Record: The experience and track record of the fund manager can impact the fund’s performance. Consider funds managed by professionals with a proven history of success.

Conclusion

Mutual funds are a versatile and accessible investment option suitable for a wide range of financial goals. They offer diversification, professional management, and the potential for solid returns. However, like all investments, they come with risks that should be carefully considered. By understanding the different types of mutual funds and aligning them with your investment objectives, you can make informed decisions to help you achieve your financial aspirations.